Countdown to August 6: Unicommerce eSolutions Limited IPO Sparks Investor Excitement

Introduction

Unicommerce eSolutions Limited, a prominent name in the e-commerce technology space, is set to capture investor attention with its upcoming Initial Public Offering (IPO) scheduled for August 6. This milestone event has created a buzz among investors and industry experts alike, with high hopes and speculations surrounding its performance. In this article, we will delve into what makes this IPO significant and what investors can expect from it.

What is an IPO?

An IPO, or Initial Public Offering, is when a private company first makes its shares available to the public. It’s a major step for companies looking to raise capital for expansion, pay down debt, or for other corporate needs. The process involves issuing shares to the public through a stock exchange, thus transitioning from a private to a publicly traded entity. The IPO process not only provides companies with necessary funding but also increases their visibility and credibility in the market.

Unicommerce eSolutions Limited: Company Profile

Company History

Founded in 2012, Unicommerce eSolutions has established itself as a key player in the e-commerce technology sector. The company provides an integrated suite of solutions designed to streamline logistics and supply chain management for e-commerce businesses.

Key Products and Services

Unicommerce offers a range of products including inventory management systems, order management solutions, and multi-channel retail management platforms. These tools are crucial for e-commerce businesses aiming to optimize their operations and enhance customer satisfaction.

Market Position and Growth

Over the years, Unicommerce has experienced robust growth, driven by the increasing demand for sophisticated e-commerce solutions. The company has a strong market presence and a growing client base, positioning it as a leader in its field.

Countdown to August 6: The IPO Announcement

IPO Date and Timetable

The much-anticipated IPO of Unicommerce eSolutions Limited is scheduled to commence on August 6. The company has outlined a detailed timetable for the offering, which will include a series of phases leading up to the public trading of its shares.

Key Details of the IPO

The IPO will involve the issuance of a certain number of shares at a price determined by the market. Investors will have the opportunity to subscribe to these shares, which will be listed on major stock exchanges. The funds raised will be utilized for strategic investments and expansion plans.

Objectives of the IPO

The primary objectives of this IPO are to raise capital for enhancing technological capabilities, expanding market reach, and funding research and development initiatives. By going public, Unicommerce aims to bolster its growth trajectory and solidify its position in the industry.

)

Investor Excitement and Market Impact

Current Market Trends

The market has been abuzz with excitement leading up to Unicommerce’s IPO, reflecting a strong investor interest in technology-driven companies. The current market trends indicate a favorable environment for tech IPOs, with increasing investor appetite for innovative solutions.

Investor Sentiment and Expectations

Investors are keenly watching Unicommerce’s IPO, anticipating strong performance due to the company’s solid market position and growth prospects. The enthusiasm is fueled by positive market sentiment and the potential for substantial returns.

Potential Risks and Rewards

Like any investment, the Unicommerce IPO comes with its set of risks and rewards. While the potential for high returns is attractive, investors must consider the inherent risks associated with IPOs, including market volatility and the company’s performance post-IPO.

Financial Health of Unicommerce eSolutions Limited

Revenue and Profitability

Unicommerce has demonstrated consistent revenue growth and profitability, which is a positive indicator for potential investors. The company’s financial health reflects its ability to generate sustainable earnings and manage its resources effectively.

Recent Financial Performance

Recent financial reports showcase strong performance metrics, with significant revenue increases and healthy profit margins. This performance underlines the company’s ability to deliver value to its shareholders.

Valuation Metrics

Valuation metrics such as price-to-earnings ratio and earnings per share will be closely monitored by investors to gauge the attractiveness of the IPO. These metrics provide insights into the company’s market value and financial health.

How to Participate in the IPO

Eligibility Criteria

To participate in the IPO, investors need to meet certain eligibility criteria set by the company and regulatory bodies. This may include having a brokerage account and fulfilling specific financial requirements.

Application Process

The application process for the IPO involves submitting an application form through a broker or financial institution. Investors will need to specify the number of shares they wish to purchase and provide necessary documentation.

Important Dates and Deadlines

Key dates for the IPO, including the subscription period and listing date, will be crucial for interested investors. Staying informed about these deadlines is essential to ensure a smooth investment process.

Expert Opinions and Analysis

Insights from Financial Analysts

Financial analysts have provided mixed opinions on the Unicommerce IPO, with many highlighting the company’s growth potential and market position. Expert analysis will be pivotal in guiding investor decisions.

Predictions for the IPO Performance

Predictions for the IPO performance suggest a strong debut, driven by the company’s robust financials and market position. However, expert forecasts will need to be monitored for any changes based on market conditions.

Comparative Analysis

Unicommerce vs. Competitors

A comparative analysis with competitors will help investors understand Unicommerce’s relative position in the market. Comparing key metrics and performance indicators will provide a clearer picture of the company’s standing.

Industry Benchmarks

Benchmarking Unicommerce against industry standards will offer insights into its performance and prospects. This comparison is crucial for assessing the company’s competitive edge.

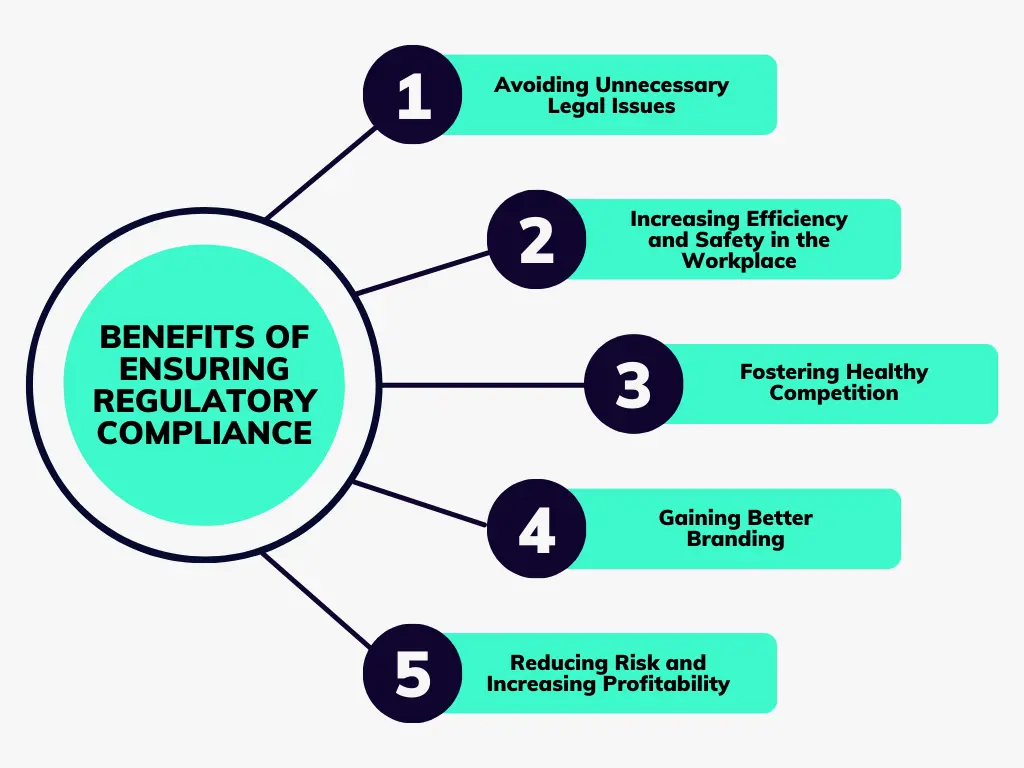

Regulatory and Compliance Aspects

SEBI Guidelines

The Securities and Exchange Board of India (SEBI) regulations play a significant role in the IPO process. Ensuring compliance with these guidelines is essential for a successful offering.

Compliance Requirements for IPOs

Adhering to regulatory requirements and disclosure norms is crucial for maintaining investor confidence and ensuring a smooth IPO process.

Post-IPO Considerations

Impact on Company’s Future

The post-IPO phase will be critical for Unicommerce as it navigates the challenges and opportunities of being a publicly traded company. Strategic decisions made during this period will influence the company’s future trajectory.

Long-Term Investment Strategy

Investors should consider their long-term investment strategy, keeping in mind the company’s growth prospects and market dynamics. A well-defined strategy will help in making informed investment decisions.

Conclusion

The countdown to August 6 marks an exciting chapter for Unicommerce eSolutions Limited as it prepares for its IPO. With strong market interest and a solid financial foundation, the company is poised for a significant debut. Investors should stay informed and consider both the opportunities and risks associated with this offering.

FAQs

What is the significance of Unicommerce’s IPO?

Unicommerce’s IPO represents a major step in its growth journey, offering investors a chance to participate in the company’s future success and expansion plans.

How can I apply for the Unicommerce IPO?

Investors can apply for the IPO through their brokerage accounts by submitting the required application forms and adhering to the deadlines.

Read More : Positive Momentum: Best RattanIndia Power’s Shares Up 2% After Q1 Losses Shrink